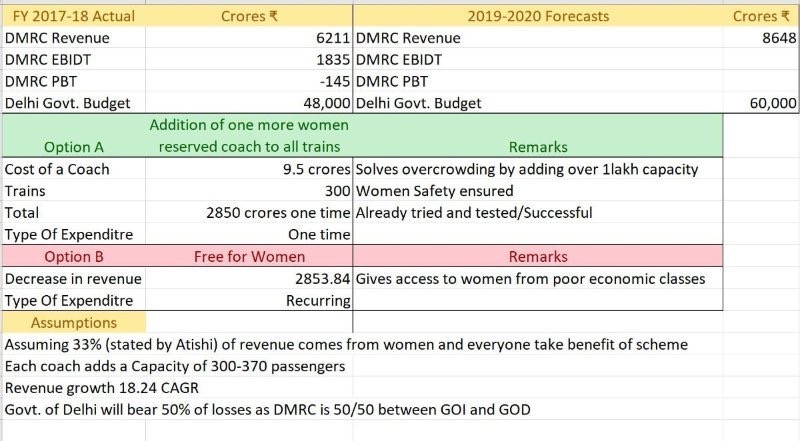

Delhi’s government announcement of free rides to all women and children in Delhi’s metro, DTC buses and cluster buses.

Analysis

•Tallinn and Estonia were the first countries to implement free rides policy but with proper referendum in which 75% people voted in favour of it.

•Also, these countries made sure that they charged one time fee from their riders, which helped them sustain some revenue.

•Women passengers accounts for around 25% to 30% of total riders in Delhi.

•Average farebox revenue per rider (ARR) of DMRC is Rs 28/- , which is one third of total farebox revenue of Delhi’s govt.

•This could lead to an annual loss of around 700-800 crores to Delhi’s government.

•As per the analysis, government would add some value added services (paid) for women, from where they will try to sustain their topline.

•Also, it is interesting to understand that metro is not limited to Delhi but also serves in national capital region (NCR), which includes states like UP and Haryana. So, are these states also ready to absorb the loss and implement this policy. It is quite interesting to understand this annoucement as the Delhi’s elections are expected to happen in 2020. So, is it another announcement for political gains or is it actually in the good interest of Delhi and its people ?

Commodity- COTTON

•US is the largest exporter of raw cotton in the world by exporting cotton worth $ 4.06 billion ( accounting for 36% of the total raw cotton exports in the world )

•China is the largest importer of raw cotton in the world by importing $9.9 billion ( accounting for 18.1% of total raw cotton imports in the world )

•China is the largest importer of cotton from India.

Impacts of trade war:

While US and China are fighting over the tariff rates, India contains the huge oppurtunity at the same time. China possess a huge demand for cotton but due to trade war, China is not able to import much cotton from US. India is trying to convince China to increase its imports of cotton from India. If China increase its imports of cotton from India then farmers will be at gain. At the same time, total exports of India will also see a marginal upswing. However, investors are still negative about the future of cotton commodity due to high regulatory risk.

Sanjiv Puri, new chairman and managing director of ITC

After the demise of chairman Yogesh Deveshwar on 11th May’2019, ITC mentioned about the new chairman in a filing to BSE.

Profile:

•Sanjiv Puri is an alumnus of IIT Kanpur and Wharton School of Business.

•He joined ITC in 1986.

•In his 33 years of journey with ITC, he held the challenging roles such as COO and also headed ITC’s FMCG.

•He also led ITC Infotech and served as managing director of Surya Nepal Pvt Ltd., a subsidiary of ITC.

Impacts:

Top management plays a crucial role in a company’s future. Bad top management can lead to several factors such as:

•Low company morale

•Reduced employee productivity

•Decrease in bottom line

•Business failure

However, ITC has managed to come up with an experienced and loyal chairman and there are no worries in respect to succession. Now, it will be great to see that how Sanjiv Puri puts his knowledge and experience together to take ITC to the next level.

JET AIRWAYS ON ITS WAY DOWN

•Spicejet recruited 100 pilots and 400 crew members of Jet Airways.

•Vistara airlines recruits 100 pilots and 450 crew members of Jet Airways.

What if Jet Airways come back in business ?

•Company will have to struggle alot to get its employees trust them again.

•Employees happens to be the most valuable asset of a company.

•If employees don’t have a trust in a company then it will be very difficult for a company to survive in a long term.

~Famous Quote: Always be nice to the people on your way up because you might meet the same people on your way down.

Apple set to be final FAANG stock to flash golden cross chart pattern.

•FAANG stocks are the market’s most popular and best performing stocks.

F- Facebook

A- Amazon

A- Apple

N- Netflix

G- Google ( Parent company- Alphabet )

•In the recent past, all other FAANG stocks except Apple has already flashed the golden cross pattern in the months of March’19 and April’19.

•Finally, Apple completed the rally.

•Golden cross pattern is the bullish pattern for the stock.

Unemployment rate

•India officially releases unemployment rate once in every five years.

•But, Indian officials have said that they will release employment data every year.

•In 2018, around 11 million people lost their jobs driven by demonetisation and GST as these policies hit millions of small businesses in late 2016 and 2017 respectively.

•In march’19, unemployment rate was reported to be 6.71 %

•According to CMIE, unemployment rate in april’19 rose to 7.6%

•The same is the affect of factory activities expanding at its slowest pace in eight months in Arpril.

Increasing unemployment rate is the main reason that ruling party is not talking about employment in their political rallies. Whereas, opposition parties are continuosly tapping the same topic to get the attention of masses.

ICICI partnered with Religare health insurance

Analysis:

Insurance sector contributes to around INR 50,000 cr per annum.

CAGR of insurance sector is 20% over the last 10 years.

Health insurance penetration in India is in single digit.

Around 56% of Indians are not covered under health insurance.

It will be third insurance principle that will be added to ICICI after Lombard and Prudential Finance.

Products will be distributed on the ICICI securities award winning platform I-Sec.

ICICI is pro-actively trying to tap the untapped insurance industry, which possesses a great scope of growth in the future. ICICI is banking on those 56% people who are not yet covered under health insurance. Partnership of ICICI with Religare is another step for ICICI to become the market leader in insurance industry.

Whereas, Religare will get 4.4 million customer base and around 200 outlets where the ICICI will sell there products. This partnership is surely a win-win situation for both the ICICI and Religare.

Hero Motocorp to almost double its capex in FY20

Analysis:

•Company is increasing its capex for the new plant in Andhra Pradesh.

•Also, increase in capex is to meet the BS-VI norms set by the government.

•All this will lead to increase in company’s assets in balance sheet.

•There will be increase in depreciation expense.

•Increase in depreciation will impact company’s bottomline, which means company’s net profit will be affected.

Though, the bottomline can be managed as addition of the new plant will help company to increase its output, which will directly help company to increase its topline. Increase in topline will help company to diminish the affect of increased depreciation on the bottomline.

Also, where its peers are putting production holidays and cutting back on output due to fall in sales. Hero Motocorp is trying to keep itself ready for the regulatory (BS-VI) norms and trying to increase their output.

Banks are shifting there focus to retail loans.

Reasons:

•Personal loan accounts showing the growth of 26% YoY.

•Credit card accounts increased by 32% YoY.

•Average balance per borrower increased by 7.7% as compared to previous year.

•Though, some of the retail loans are unsecured but still they have the delinquency rate of less than 3%.

•Delinquency rates

Credit card accounts: 0.52%

Auto loans: 2.75%

Loans against property: 3%

Higher growth rates and lower delinquency rates are attracting banks to shift there focus to retail loans in a time when almost all the banks are struggling with increasing NPAs.